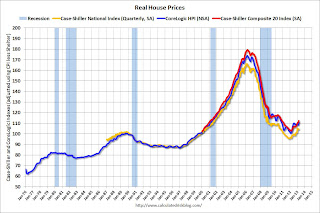

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation. This is why economists also look at real house prices (inflation adjusted).

Note: If were I "wishcasting" as opposed to "forecasting", I'd like to see real house prices mostly move sideways for a few years. But given the low level of inventory, pent up demand, significant investor buying, and some bounce off the bottom in certain areas - real prices have been increasing fairly rapidly over the last year. I expect more inventory to come on the market and for price increases to slow.

Earlier: Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

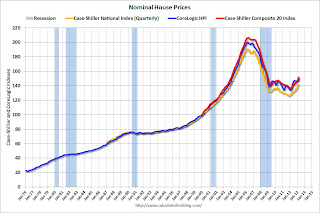

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q3 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to December 2003 levels, and the CoreLogic index (NSA) is back to February 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q2 2000 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to March 2001.

In real terms, house prices are back to early '00s levels.

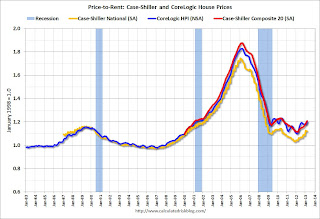

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2000 levels, the Composite 20 index is back to February 2001 levels, and the CoreLogic index is back to March 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

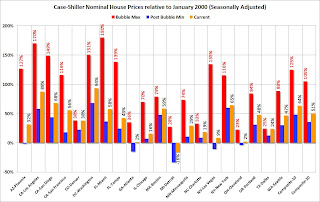

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 32% above January 2000. Some cities - like Denver and Dallas - are close to the peak level. Detroit prices are still below the January 2000 level.

No comments:

Post a Comment