First, we don't know the actual number for April yet - and we don't know about May and June - but even if PCE were flat for all three months compared to March, quarterly PCE would grow 1.3% in Q2. This is because quarterly PCE is calculated as an average of the current quarter divided by the average for the previous quarter (seasonally adjusted and annualized).

The following table shows how this works. For Q4 2012, PCE averaged $9,663.8 SAAR (Seasonally Adjusted Annual Rate, billions, 2005 dollars). For Q1 2013, PCE averaged $9,740.0.

If we divided $9,740.0 by $9,663.8 we get 1.007885. Then annualize (take to the fourth power) and subtract 1, and the growth rate is 3.2% (just what the BEA reported for PCE growth in Q1).

If we do the same calculation for Q2, even if PCE is flat for all three months in Q2 (April, May and June), PCE will grow by 1.3% in Q2.

| Q2 Personal Consumption Expenditure (PCE) Growth | ||||

|---|---|---|---|---|

| Quarter | Month | Real PCE, SAAR 2005 dollars (Billions) | Qtr Average | Qtr Growth Rate |

| Oct-12 | $9,629.5 | |||

| Q4 | Nov-12 | $9,673.0 | $9,663.8 | |

| Dec-12 | $9,689.0 | |||

| Jan-13 | $9,708.7 | |||

| Q1 | Feb-13 | $9,740.3 | $9,740.0 | 3.2% |

| Mar-13 | $9,771.1 | |||

| Apr-13 | $9,771.11 | |||

| Q2 | May-13 | $9,771.1 | 1.3% | |

| Jun-13 | ||||

| 1Consensus forecast for April 2013 | ||||

If instead we just compare April to January, PCE would be growing at a 2.6% annual rate in Q2. This is one of the reasons several analysts have recently upgraded their forecasts for Q2 GDP. It appears likely that PCE growth will be above 2% in Q2. Of course government spending - especially Federal government spending - will probably remain a drag on GDP in Q2 (there has been record shrinkage of the public sector over the last several years).

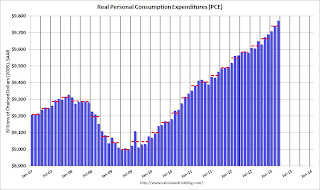

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Since PCE grew at just under a 4% annualized rate in February and March (and quarterly PCE is an average for the quarter), if PCE is flat in April, May and June, PCE already has some growth built in for Q2 compared to Q1.

No comments:

Post a Comment