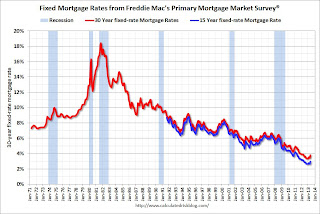

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates following long-term government bond yields higher. The average 30-year fixed moved up nearly half a percentage point since the beginning of May when it averaged 3.35 percent. ...

30-year fixed-rate mortgage (FRM) averaged 3.81 percent with an average 0.8 point for the week ending May 30, 2013, up from last week when it averaged 3.59 percent. Last year at this time, the 30-year FRM averaged 3.75 percent.

15-year FRM this week averaged 2.98 percent with an average 0.7 point, up from last week when it averaged 2.77 percent. A year ago at this time, the 15-year FRM averaged 2.97 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®. Not much of an increase recently, but this is the highest level in a year.

This is a weekly average for the week ending May 30th. Rates moved higher over the last couple of days, and 30 year rates will probably be close to 4% in the next survey if Treasury yields remain at the current level.

Note: The Freddie Mac survey started in 1971 and rates were below 5% in earlier periods.

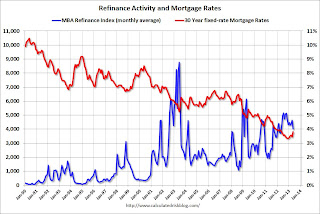

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 30% over the last 3 weeks) and will probably decline significantly if rates stay at this level.

No comments:

Post a Comment