The FDIC released its Quarterly Banking Profile for the first quarter of 2013, and according to the report the carrying value of 1-4 family residential real estate owned (REO) by FDIC-insured institutions at the end of March was $7.89 billion, down from $8.34 billion at the end of December, and down from $11.08 billion at the end of March 2012.

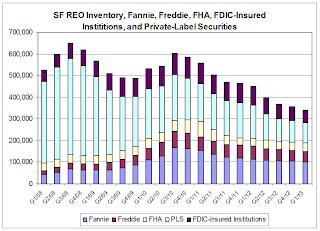

Assuming that the average carrying value of SF REO at FDIC-insured institutions is 50% higher than the average for Fannie Mae and Freddie Mac, here is a chart showing quarterly SF REO inventories at Fannie, Freddie, FHA, FDIC-insured institutions and private-label securities. (The source of my PLS data only had data through the end of February, which I used for Q1/2013).

Click on graph for larger image.

Click on graph for larger image.SF REO inventories at these entities totaled an estimated 341,439 at the end of March, down 24% from last March, down 39% from March 2011, and down 47% from September 2008.

No comments:

Post a Comment