|

| Fuse/Thinkstock |

Read: Yahoo!'s New Homepage Starts Going Global

|

| Fuse/Thinkstock |

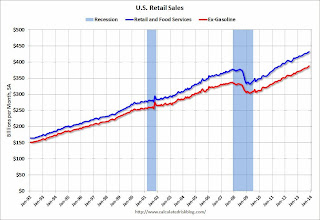

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $432.3 billion, an increase of 0.7 percent from the previous month, and 4.7 percent above November 2012. ... The September to October 2013 percent change was revised from +0.4 percent to +0.6 percent.

Click on graph for larger image.

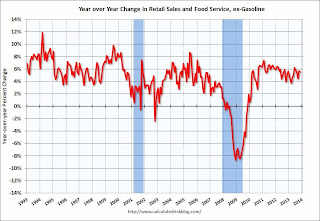

Click on graph for larger image. Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).In the week ending December 7, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 68,000 from the previous week's revised figure of 300,000. The 4-week moving average was 328,750, an increase of 6,000 from the previous week's revised average of 322,750.The previous week was up from 298,000.

Click on graph for larger image.

Click on graph for larger image.An experimental bond-trading program being run at the Federal Reserve Bank of New York could fundamentally change the way the central bank sets interest rates.Thursday:

Fed officials see the program, known as a "reverse repo" facility, as a potentially critical tool when they want to raise short-term rates in the future to fend off broader threats to the economy.

...

"The Federal Reserve has never tightened monetary policy, or even tried to maintain short-term interest rates significantly above zero, with such abundant amounts of liquidity in the financial system," according to a draft of a new research paper by Brian Sack, the former head of the New York Fed's markets group, and Joseph Gagnon, an economist at the Peterson Institute for International Economics and a former Fed economist.

...

When it does want to raise rates, the Fed under the repo program would use securities it accumulated through its bond-buying programs as collateral for loans from money-market mutual funds, banks, securities dealers, government-sponsored enterprises and others.

The rates it sets on these loans, in theory, could become a new benchmark for global credit markets.

Click on graph for larger image.

Click on graph for larger image. Click on graph for larger image.

Click on graph for larger image.