|

| Fuse/Thinkstock |

Read: Yahoo!'s New Homepage Starts Going Global

|

| Fuse/Thinkstock |

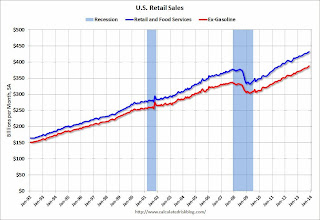

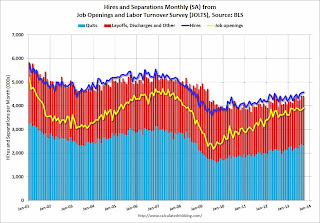

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $432.3 billion, an increase of 0.7 percent from the previous month, and 4.7 percent above November 2012. ... The September to October 2013 percent change was revised from +0.4 percent to +0.6 percent.

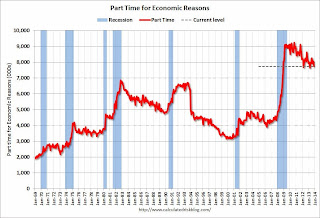

Click on graph for larger image.

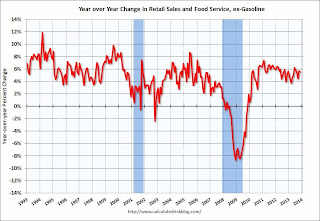

Click on graph for larger image. Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).In the week ending December 7, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 68,000 from the previous week's revised figure of 300,000. The 4-week moving average was 328,750, an increase of 6,000 from the previous week's revised average of 322,750.The previous week was up from 298,000.

Click on graph for larger image.

Click on graph for larger image.An experimental bond-trading program being run at the Federal Reserve Bank of New York could fundamentally change the way the central bank sets interest rates.Thursday:

Fed officials see the program, known as a "reverse repo" facility, as a potentially critical tool when they want to raise short-term rates in the future to fend off broader threats to the economy.

...

"The Federal Reserve has never tightened monetary policy, or even tried to maintain short-term interest rates significantly above zero, with such abundant amounts of liquidity in the financial system," according to a draft of a new research paper by Brian Sack, the former head of the New York Fed's markets group, and Joseph Gagnon, an economist at the Peterson Institute for International Economics and a former Fed economist.

...

When it does want to raise rates, the Fed under the repo program would use securities it accumulated through its bond-buying programs as collateral for loans from money-market mutual funds, banks, securities dealers, government-sponsored enterprises and others.

The rates it sets on these loans, in theory, could become a new benchmark for global credit markets.

Click on graph for larger image.

Click on graph for larger image. Click on graph for larger image.

Click on graph for larger image. |

| iStock/Thinkstock |

“We’ll [says Hunter] be looking all around the world [for] any opportunities where it may be a business opportunity for us or a partnership or an association.”Read the entire article: Qatar Duty Free Signals Ambitions For International Expansion

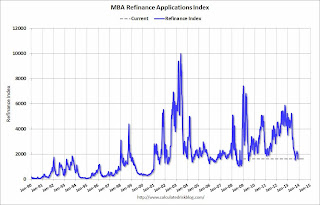

Mortgage applications increased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 6, 2013. The previous week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index increased 2 percent from the previous week and was 16 percent lower than the week prior to Thanksgiving. The seasonally adjusted Purchase Index increased 1 percent from one week earlier and was 3 percent lower than the week prior to Thanksgiving. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.61 percent, the highest rate since September, from 4.51 percent, with points decreasing to 0.26 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

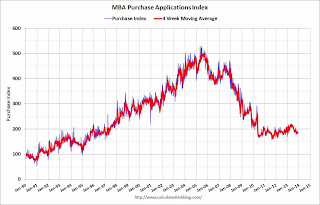

Click on graph for larger image. The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The agreement eliminates about $65 billion in across-the-board domestic and defense cuts while adding an additional $25 billion in deficit reduction by extending a 2 percent cut to Medicare through 2022 and 2023, two years beyond the cuts set by the Budget Control Act of 2011.And from the WSJ: House, Senate Negotiators Announce Budget Deal

...

Under the agreement, military and domestic spending for the current fiscal year that is under the annual discretion of Congress would rise to just over $1 trillion, from the $967 billion level it would hit if spending cuts known as sequestration were imposed next month. Spending would be capped at $1 trillion in fiscal year 2015 as well.

Revenues to fund the higher spending would come from changes to federal employee and military pension programs, and higher fees for airline passengers, among other sources. An extension of long-term unemployment benefits, sought by Democrats, wasn't included.In 2013, the key downside risk to the economy was Congress (specifically the House), and unfortunately they delivered. Hopefully this eliminates that risk for 2014.

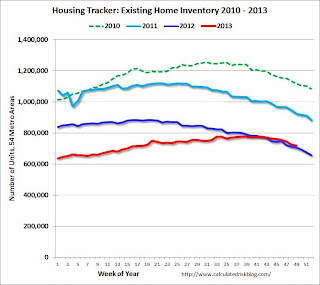

"While I do not have enough reports to produce an accurate estimate of existing home sales for November, reports I’ve seen so far suggest that home sales declined again on a seasonally adjusted basis last month."From CR: This is just a few markets, but total "distressed" share is down significantly, mostly because of a decline in short sales. Foreclosure are down in most areas too.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | |

| Las Vegas | 21.0% | 41.2% | 7.0% | 10.7% | 28.0% | 51.9% | 43.7% | 52.7% |

| Reno | 17.0% | 41.0% | 6.0% | 9.0% | 23.0% | 50.0% | ||

| Phoenix | 7.8% | 23.2% | 8.0% | 12.9% | 15.8% | 36.1% | ||

| Mid-Atlantic | 7.5% | 11.9% | 8.1% | 8.7% | 15.7% | 20.6% | 19.6% | 20.0% |

| Tucson | 32.2% | 33.8% | ||||||

| Toledo | 37.2% | 40.9% | ||||||

| Omaha | 21.6% | 19.8% | ||||||

| Spokane | 16.0% | 9.1% | ||||||

| Memphis* | 20.4% | 24.4% | ||||||

| Springfield IL | 17.0% | 15.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

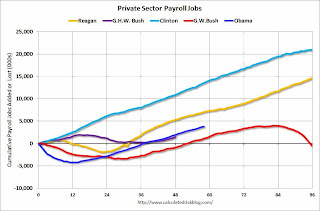

Click on graph for larger image.

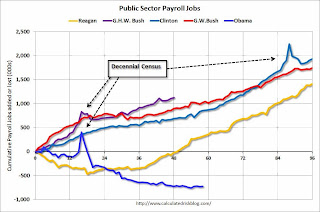

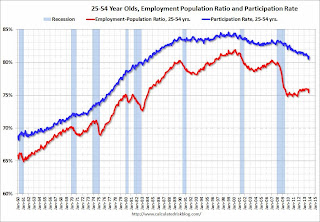

Click on graph for larger image. A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010. GLVAR said the total number of existing local homes, condominiums and townhomes sold in November was 2,694. That’s down from 3,192 in October and down from 3,293 total sales in November 2012. Compared to October, single-family home sales during November decreased by 16.2 percent, while sales of condos and townhomes decreased by 12.7 percent. Compared to one year ago, single-family home sales were down 17.9 percent, while condo and townhome sales were down 19.3 percent. ...There are several key trends that we've been following:

...

In November, 21 percent of all existing home sales were short sales, unchanged from October. Another 7 percent of all November sales were bank-owned properties, up from 6 percent in October. The remaining 72 percent of all sales were the traditional type, down from 73 percent in October.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in November, with 14,240 single-family homes listed for sale at the end of the month. That’s down 5.1 percent from 15,011 single-family homes listed for sale at the end of October and down 8.9 percent from one year ago. ...

By the end of November, GLVAR reported 6,830 single-family homes listed without any sort of offer. That’s down 3.4 percent from 7,072 such homes listed in October, but still up 77.4 percent from one year ago. For condos and townhomes, the 2,192 properties listed without offers in November represented a 2.4 percent decrease from 2,247 such properties listed in October, but an 80.0 percent increase from one year ago.

emphasis added

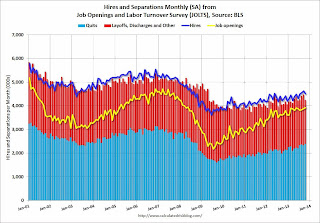

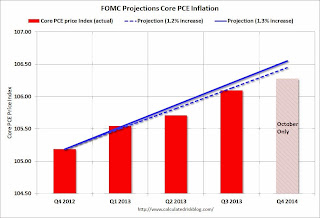

There were 3.9 million job openings on the last business day of October, little changed from September, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were also little changed in October. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in October for total nonfarm and total private and was little changed for government.

Click on graph for larger image.

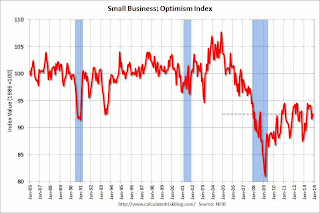

Click on graph for larger image.Owner sentiment increased by 0.9 points to 92.5 ... Over half of the improvement was accounted for by the labor market components which is certainly good news, lifting them closer to normal levels.

Fifty-one percent of the owners hired or tried to hire in the last three months and 44 percent reported few or no qualified applicants for open positions. This is the highest level of hiring activity since October 2007.

Click on graph for larger image.

Click on graph for larger image. |

| iStock/Thinkstock |

Mortgage-finance giants Fannie Mae and Freddie Mac will boost certain fees that they charge lenders ... The firms’ federal regulator, the Federal Housing Finance Agency, said Monday it would direct the companies to increase by 0.1 percentage points the so-called “guarantee” fees that the companies charge to lenders. Those fees have nearly doubled since 2009.It is clearly appropriate to charge higher fees in states with higher costs. Maybe there will be a move towards a national foreclosure law ...

But the latest increase will be muted in most states because the FHFA also said that it would direct the companies to eliminate separate fees that had been implemented in the aftermath of the financial crisis. ...

The upshot is that borrowing costs could rise slightly in the four states—New York, Florida, New Jersey and Connecticut—where the latest fee increases won’t be offset by the removal of the crisis-era fees.

Click on graph for larger image.

Click on graph for larger image. Click on graph for larger image.

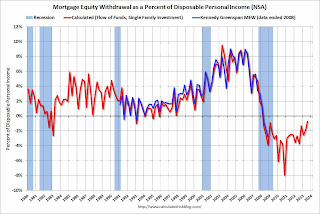

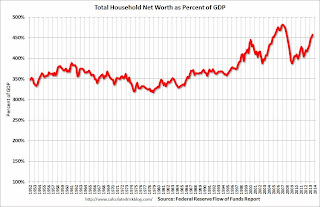

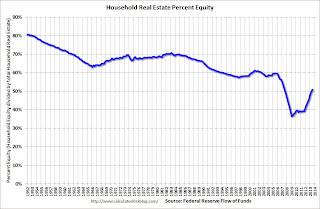

Click on graph for larger image. This graph shows homeowner percent equity since 1952.

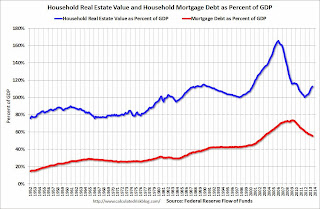

This graph shows homeowner percent equity since 1952.  The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. The budget deal Patty Murray and Paul Ryan are crafting isn't a "grand bargain." ... But the deal does lift about a third of sequestration's cuts while giving agencies more flexibility to deal with the rest. It does mean the 2014 budget is the work of human hands rather than automatic cuts. It might be a vehicle for Capitol Hill to extend expiring unemployment benefits. And it would be a small but real boost to the economy.Reducing the sequester budget cuts is good policy. And it would be good economics (and good overall policy) to extend the emergency unemployment benefits too - but it isn't clear if that will happen.

Joel Prakken of Macroeconomic Advisors says the deal "would be a modest boost to GDP growth (relative to sequester). Maybe 1/4 percentage point." Moody's Mark Zandi adds in the possibility of extending unemployment insurance and estimates that "the lift to GDP next year compared to current law is .4. Small, but it matters."

|

| iStock/Thinkstock |

“Translating all but the smallest websites into multiple languages can be as grueling as producing original content,” said Henderson. “For one thing, translating web content is not as simple as translating print copy. The language is served live by host systems, and special inter-dependencies exist between multiple language versions for the sake of efficiency and accuracy.”Read the entire article: Website translation crucial to entering global markets

Federal Reserve officials are in no hurry to retreat from their bond-buying campaign to stimulate the economy and are likely to postpone any cuts to the program until next year, according to public statements by Fed officials and interviews with some of them.I still think there is a chance that the taper will start in December, but the consensus seems to be early in 2014 (either at the January or March meeting).

...

[I]nfluential Fed officials see little harm in postponing the decision, particularly compared with the risks of pulling back too soon. Significant details of the eventual retreat also remain the subjects of unresolved debates, according to the public statements and interviews. And some officials argue that the slow pace of inflation is itself a reason for the Fed to maintain its stimulus campaign.

House and Senate negotiators were putting the finishing touches Sunday on what would be the first successful budget accord since 2011 ...Cutting back the sequester is good economic policy, and we don't need more austerity right now ... so this agreement will be a positive for the economy.

Senior aides familiar with the talks say the emerging agreement aims to partially repeal the sequester and raise agency spending to roughly $1.015 trillion in fiscal 2014 and 2015. That would bring agency budgets up to the target already in place for fiscal 2016. To cover the cost, Ryan and Murray are haggling over roughly $65 billion in alternative policies, including cuts to federal worker pensions and higher security fees for the nation’s airline passengers.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

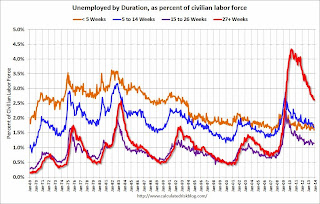

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

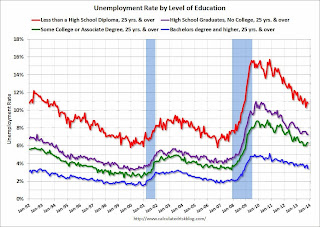

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more. This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

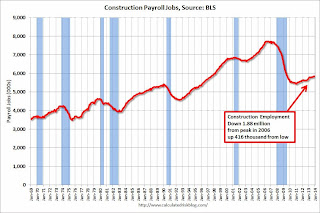

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older). This graph shows total construction employment as reported by the BLS (not just residential).

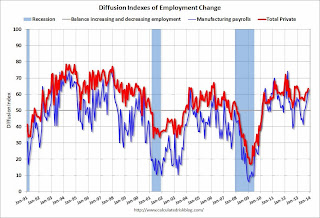

This graph shows total construction employment as reported by the BLS (not just residential). The BLS diffusion index for total private employment was at 63.5 in November, up from 61.1 in October.

The BLS diffusion index for total private employment was at 63.5 in November, up from 61.1 in October.Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in November (a good sign).

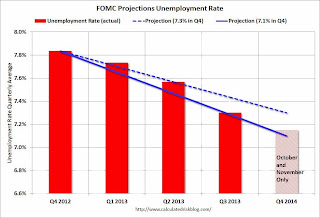

Click on graph for larger image.

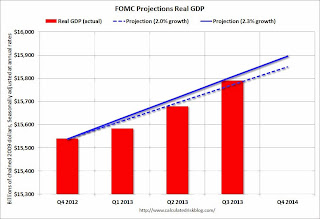

Click on graph for larger image. The second graph is for GDP.

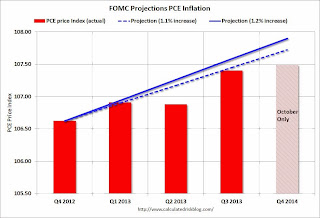

The second graph is for GDP. The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June. The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013. 10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.  8:30 AM ET: Retail sales for November will be released.

8:30 AM ET: Retail sales for November will be released.There were only two removals this week to the Unofficial Problem Bank List, which now stand at 643 institutions with assets of $219.8 billion. A year ago, the list held 849 institutions with assets of $316.2 billion.Note on the unofficial list:

The Federal Reserve terminated the Written Agreement against Peoples Bank, Lawrence, KS ($412 million). Metropolitan National Bank, Little Rock, AR ($973 million) merged with Simmons First National Bank, Pine Bluff, AR to exit the list.

There is nothing new to report on the status of the banking subsidiaries controlled by Capitol Bancorp, Ltd. Next week should be fairly quiet as we do not anticipate the OCC releasing its latest action activity until December 20th.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

|

| Photo courtesy: OfficeMax |

|

| Photo courtesy: OfficeMax |

|

| Photo courtesy: OfficeMax |

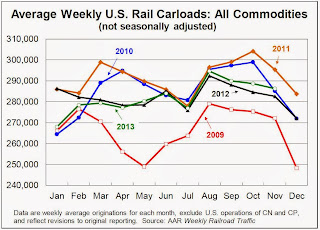

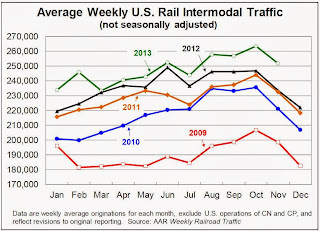

The Association of American Railroads (AAR) today reported increased U.S. rail traffic for November 2013 over November 2012. Intermodal traffic in November totaled 1,007,549 containers and trailers, up 7.8 percent (73,004 units) compared with November 2012. The weekly average of 251,887 intermodal containers and trailers per week in November 2013 was the highest weekly average for any November in history. Carloads originated in November 2013 totaled 1,145,353, up 1.3 percent (14,931 carloads) compared with the same month last year.

...

Excluding coal, U.S. carloads were up 5.3 percent, or 34,988 carloads, in November 2013 compared with November 2012. Excluding coal and grain, U.S. carloads were up 3.3 percent, or 19,303 carloads, in November.

“U.S. rail traffic in November 2013 saw a big decline in coal carloads that was more than offset by gains in carloads of grain and petroleum products,” said AAR Senior Vice President John T. Gray. “Carload traffic continues to be consistent with an economy that’s growing at a moderate pace. Meanwhile, rail intermodal volume was extremely strong in November, demonstrating the tremendous value that intermodal has become for rail customers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.U.S. rail carloads were up 1.3% (14,931 carloads) in November 2013 over November 2012, totaling 1,145,353 carloads for the month. That’s the fourth consecutive year-over-year monthly increase, the first time that’s happened in two years. The weekly average in November 2013 was 286,338 carloads ...

Among the 20 commodity categories tracked by the AAR each month, grain had by far the biggest carload gain in November, with grain carloads up 15,685 (20.6%) over the same month last year. ... Carloads of petroleum and petroleum products averaged 14,532 per week in November 2013, up 20.0% over November 2012.

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.U.S. railroads originated an average of 251,887 intermodal containers and trailers per week in November 2013, easily the highest weekly average for any November in history and up 7.8% (73,004 intermodal units) over November 2012. That’s the biggest year-over-year percentage change in nine months.Rail traffic and the economy usually grow together, so this is a good sign for the overall economy.

To date, the peak full year for U.S. rail intermodal volume is 2006, when originations totaled 12.3 million containers and trailers. In order for 2013 not to set an annual record, intermodal volume in December 2013 would have to average no more than approximately 102,000 units per week. So far in 2013, the weekly average has been more than 247,000 units, so it’s a safe bet that next month in this space we’ll be reporting that 2013 was a record year for intermodal.

The federal government ran a budget deficit of $231 billion for the first two months of fiscal year 2014, $61 billion less than the shortfall recorded in October and November of last year, CBO estimates.The most recent CBO projection put the fiscal 2014 deficit at 3.3% of GDP, down from 4.1% in fiscal 2013. These monthly deficits suggest even more improvement in fiscal 2014 than originally forecast.

...

Receipts for the first two months of fiscal year 2014 totaled $380 billion, CBO estimates—$34 billion more than receipts during the same period last year.

...

Outlays for the first two months of fiscal year 2014 were $27 billion less than they were during the same period last year, CBO estimates. That decrease would have been slightly larger if not for shifts in the timing of certain payments from December to November (because December 1 fell on a weekend in both years). Without those timing shifts, CBO estimates, spending would have declined by $29 billion (or 5 percent).

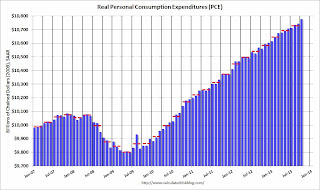

Personal income decreased $10.8 billion, or 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $32.7 billion, or 0.3 percent.On inflation, the PCE price index decreased at a 0.4% annual rate in October, and core PCE prices increased at a 0.9% annual rate. This is very low and far below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in October, compared with an increase of 0.1 percent in September. ... The price index for PCE decreased less than 0.1 percent in October, in contrast to an increase of 0.1 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

Click on graph for larger image.

Click on graph for larger image.

Click on graph for larger image.

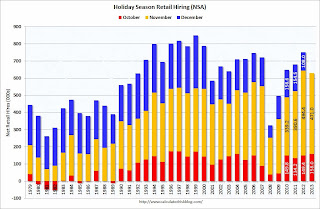

Click on graph for larger image. Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

From the BLS report:

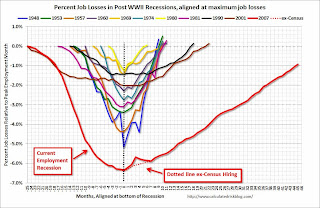

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 331,000 to 7.7 million in November. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.This more than reversed the increase in part time workers that happened in October due to the government shutdown.

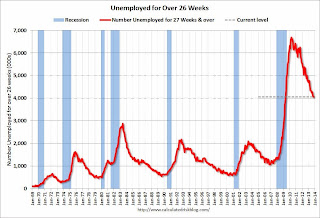

This graph shows the number of workers unemployed for 27 weeks or more.

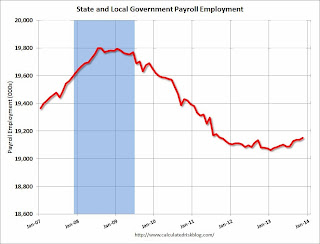

This graph shows the number of workers unemployed for 27 weeks or more.  This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)