The key report this week is the delayed September employment report on Tuesday.

Other key reports this week are September Existing Home Sales on Monday, and New Home sales on Thursday (not confirmed release).

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for October will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data and will probably be delayed.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September.

A key will be inventory and months-of-supply.

8:30 AM: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August.

The consensus is for the unemployment rate to be unchanged at 7.3% in September.

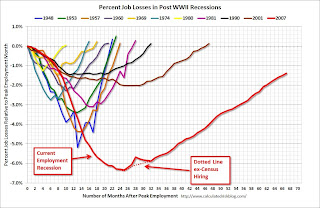

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).There are still 1.4 million fewer private sector jobs now than when the recession started in 2007.

9:00 AM: Chemical Activity Barometer (CAB) for October from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for August 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: New Home Sales for September from the Census Bureau.

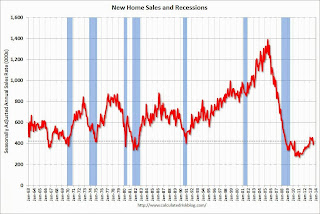

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for a decrease in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 420 thousand in August.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

No comments:

Post a Comment