Also the Fed will release the Q2 Flow of Funds report this week, and the Pending Home Sales index for August might show a sharp decline.

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for September will be released this week.

Note: My guess is Janet Yellen will be nominated as Fed Chair this week, perhaps on Monday.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash for September. The consensus is for an increase to 54.0 from 53.9 in August.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July.

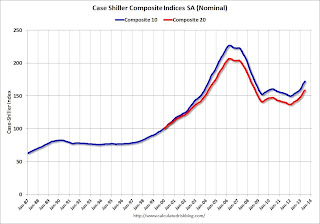

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA). The Zillow forecast is for the Composite 20 to increase 12.5% year-over-year, and for prices to increase 1.2% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for July 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for the index to decrease to 80.0 from 81.5.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for a reading of 10.5 for this survey, down from 14 in August (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.5% decline in durable goods orders.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 394 thousand in July. Based on the various reports, sales were probably weak again in August.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 309 thousand last week.

8:30 AM: Q2 GDP (third estimate). This is the second estimate of Q2 GDP from the BEA. The consensus is that real GDP increased 2.6% annualized in Q2, revised up from the second estimate of 2.5% in Q2.

10:00 AM ET: Pending Home Sales Index for August. The consensus is for a 1.0% decrease in the index. Economist Tom Lawler is estimating the NAR will report a decline of "about 5%" in this index.

10:00 AM: 2013 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS: "[T]he Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. ... The final benchmark revision will be issued with the publication of the January 2014 Employment Situation news release in February."

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 78.0, up from the preliminary reading of 76.8, but down from the August reading of 82.1.

No comments:

Post a Comment