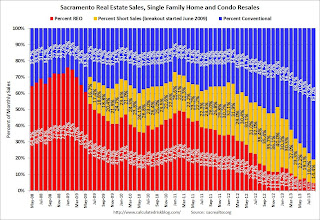

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In August 2013, 19.0% of all resales (single family homes) were distressed sales. This was down from 23.1% last month, and down from 52.0% in August 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 4.6% (the lowest since the data was tracked), and the percentage of short sales decreased to 14.4%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 46.8% year-over-year in July. This is the fourth consecutive month with a year-over-year increase in inventory - clearly inventory has bottomed in Sacramento.

Cash buyers accounted for 25.4% of all sales, down from 25.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 12% from August 2012, but conventional sales were up 48% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

If this data is a hint at what will happen in other areas, we can expect: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales. 3) Less investor buying, 4) more inventory, and 5) slower price increases.

No comments:

Post a Comment