Looking at the first eight months of 2013, there has been a significant increase in new home sales this year. The Census Bureau reported that there were 304 new homes sold during the first eight months of 2013, up 19.7% from the 254 thousand sold during the same period in 2012.

The year-over-year increases have slowed - August only saw a year-over-year increase of 12.6%, but I still expect new home sales to be up 15% to 20% for the year. That follows an annual increase of 21% in 2012.

And even though there has been a large increase in the sales rate, sales are close to the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current 421 thousand sales rate.

The housing recovery has slowed, but it is ongoing - and I expect the recovery to continue for some time.

Note: As I mentioned last month, any impact from rising mortgage rates would show up in the New Home sales report before the existing home sales report. New home sales are counted when contracts are signed, and existing home sales when the transactions are closed - so the timing is different. For existing home sales, I think there was a push to close before the mortgage interest rate lock expired - so closed existing home sales in July and August were strong - and I expect a decline in existing home sales soon.

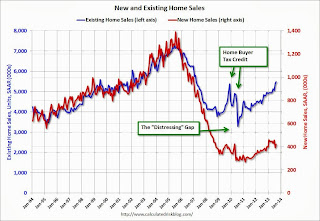

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through August 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to continue to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

No comments:

Post a Comment