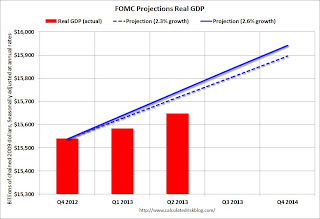

Here is an update to the GDP chart including the 2nd estimate of GDP released this morning (Q2 GDP growth was revised up to annual rate of 2.5% from the 1.7% advance estimate). Note: Here are the most recent updates to the four charts. I'll update two more charts tomorrow (PCE and core inflation).

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

Combined the first and second quarter were below the FOMC projections. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

Friday:

• 8:30 AM ET, Personal Income and Outlays for July. The consensus is for a 0.2% increase in personal income in June, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, the Chicago Purchasing Managers Index for August. The consensus is for an increase to 53.0, up from 52.3 in July.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 80.0.

No comments:

Post a Comment