This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the Q2 National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Climbing in June 2013 According to the S&P/Case-Shiller Home Price Indices

Data through June 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1Home Price Indices ... showed that prices continue to increase. The National Index grew 7.1% in the second quarter and 10.1% over the last four quarters. The 10-City and 20-City Composites posted returns of 2.2% for June and 11.9% and 12.1% over 12 months. ...

All 20 cities posted gains on a monthly and annual basis. However, in only six cities were prices rising faster this month than last, compared to ten in May. Dallas and Denver reached new all-time highs as they did last month, with returns of +1.7% each in June. ...

“Overall, the report shows that housing prices are rising but the pace may be slowing. Thirteen out of twenty cities saw their returns weaken from May to June. As we are in the middle of a seasonal buying period, we should expect to see the most gains. With interest rates rising to almost 4.6%, home buyers may be discouraged and sharp increases may be dampened." [says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices]

All 20 cities showed positive monthly returns for at least the third consecutive month. Six cities – Charlotte, Cleveland, Las Vegas, Minneapolis, New York and Tampa – showed acceleration. Atlanta took the lead with a return of 3.4% as San Francisco dropped to +2.7% in June from +4.3% in May. New York posted a gain of 2.1%, its highest since July 2002.

Click on graph for larger image.

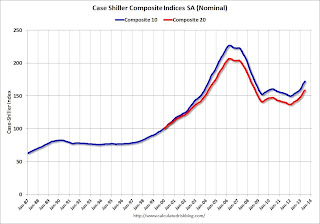

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 24.1% from the peak, and up 1.1% in June (SA). The Composite 10 is up 15.1% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 23.4% from the peak, and up 0.9% (SA) in June. The Composite 20 is up 15.7% from the post-bubble low set in Jan 2012 (SA).

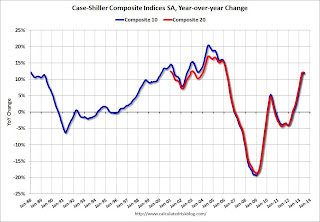

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 11.9% compared to June 2012.

The Composite 20 SA is up 12.1% compared to June 2012. This was the thirteen consecutive month with a year-over-year gain and it appears the YoY change might be starting to slow.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in June seasonally adjusted. Prices in Las Vegas are off 50.2% from the peak, and prices in Denver and Dallas are at new highs.

This was close to the consensus forecast for a 12.2% YoY increase. I'll have more on prices later.

No comments:

Post a Comment