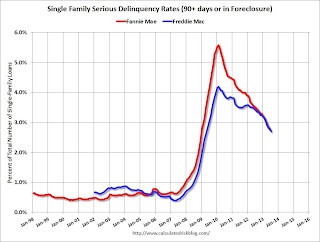

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

I'm frequently asked when the distressed sales will be back to normal levels, and that will happen when the percent of seriously delinquent loans (and in foreclosure) is back to normal.

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for July next week.

Click on graph for larger image

Click on graph for larger imageAlthough this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or so. Therefore I expect a fairly high level of distressed sales for 2 to 3 more years (mostly in judicial states).

No comments:

Post a Comment