On Thursday, there will be a confirmation hearing for Janet Yellen as the new Fed Chair. Yellen is qualified, has an excellent track record (she has been "hawkish" when appropriate, and "dovish" when appropriate), and I expect she will be confirmed by a large majority.

Government offices, banks and the bond market will be closed in observance of the Veteran's Day holiday. Stock markets will be open.

7:30 AM ET: NFIB Small Business Optimism Index for October.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. Imports and export were mostly unchanged in August.

The consensus is for the U.S. trade deficit to increase to $39.1 billion in September from $38.8 billion in August.

10:00 AM: Confirmation Hearing, Nominee for Fed Chair Janet Yellen

11:00 AM: The Q3 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

8:30 AM: NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 5.5, up from 1.5 in October (above zero is expansion).

9:15 AM: The Fed is scheduled to release Industrial Production and Capacity Utilization for October.

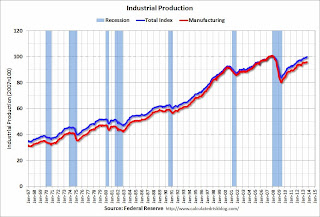

9:15 AM: The Fed is scheduled to release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.3%.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.4% increase in inventories.

No comments:

Post a Comment