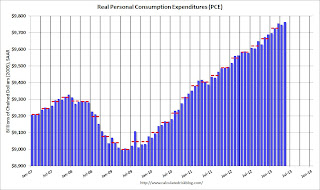

Personal income increased $69.4 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April. ... The price index for PCE increased 0.1 percent in May, in contrast to a decrease of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q2 PCE growth (first two months of the quarter), PCE was increasing at a 1.8% annual rate in Q2 2013 (using mid-month method, PCE was increasing at 1.5% rate). This suggests GDP growth will be weaker in Q2 than in Q1.

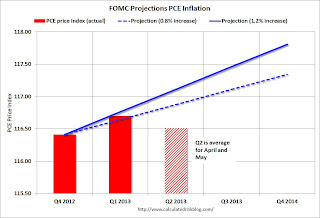

Last week I posted Four Charts to Track Timing for QE3 Tapering . Here is an update to the inflation charts.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

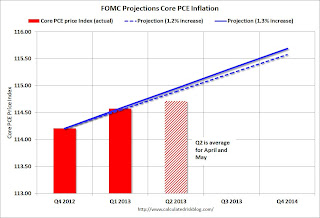

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy AND an increase in inflation. (September tapering is less likely, but not impossible - but the pickup would have to be significant over the next two months).

No comments:

Post a Comment