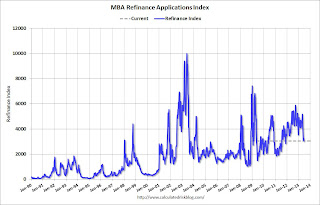

The Refinance Index decreased 5 percent from the previous week to the lowest level since November 2011. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

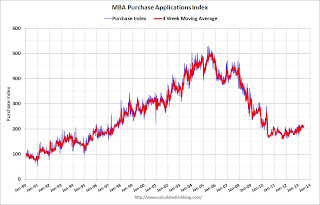

“Interest rates moved up sharply following the Federal Reserve press conference last Wednesday where it was indicated that the Fed could begin tapering their asset purchases later this year,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Mortgage rates increased by the most in a single week since 2011, and refinance application volume dropped to its lowest level in almost two years. However, applications for conventional purchase loans picked up by more than 3 percent over the week, and total purchase applications were 16 percent higher than one year ago, indicating that homebuyers are not yet dissuaded by the increase in mortgage rates. Government purchase applications dropped again, likely a function of the recent increase in FHA mortgage insurance premiums.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.46 percent, the highest rate since August 2011, from 4.17 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates near 4.5%, refinance activity has fallen sharply, decreasing in 6 of the last 7 weeks.

This index is down 42% over the last seven weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

No comments:

Post a Comment