This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Set Record Monthly Rise in April 2013 According to the S&P/Case-Shiller Home Price Indices

Data through April 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... showed average home prices increased 11.6% and 12.1% for the 10- and 20-City Composites in the 12 months ending in April 2013. From March to April, the 10- and 20-City Composites rose 2.6% and 2.5%.

All 20 cities and both Composites showed positive year-over-year returns for at least the fourth consecutive month. Atlanta, Dallas, Detroit and Minneapolis posted their highest annual gains since the start of their respective indices. On a monthly basis, all cities with the exception of Detroit posted positive change.

“The 10- and 20-City Composites posted their highest monthly gains in the history of S&P/Case-Shiller Home Price Indices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Thirteen cities posted monthly increases of over two percentage points, with San Francisco leading at 4.9%."

For the month of April, 19 of the 20 cities showed positive returns; Detroit was the only MSA to remain flat. Compared to March 2013, thirteen cities showed improvement with Minneapolis showing the largest change with a gain of 2.9% compared to its March return of -1.1%. California is seeing impressive returns all around with gains ranging from 3.4% to 4.9%. Los Angeles, San Diego and San Francisco posted their highest gains since 2004, 1988 and 1987, respectively. Looking at the east coast, Miami showed its largest return, 2.4%, in seven and a half years.

Click on graph for larger image.

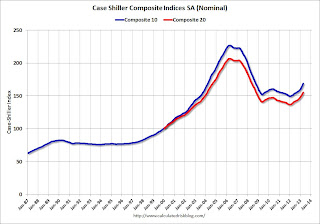

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 25.6% from the peak, and up 1.7% in April (SA). The Composite 10 is up 12.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 24.8% from the peak, and up 1.7% (SA) in April. The Composite 20 is up 13.5% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 11.6% compared to April 2012.

The Composite 20 SA is up 12.1% compared to April 2012. This was the eleventh consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in April seasonally adjusted. Prices in Las Vegas are off 52.6% from the peak, and prices in Denver and Dallas are at new highs.

This was above the consensus forecast for a 10.9% YoY increase. I'll have more on prices later.

No comments:

Post a Comment