Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 26, 2013. ...

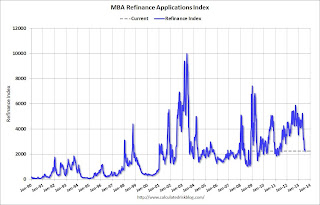

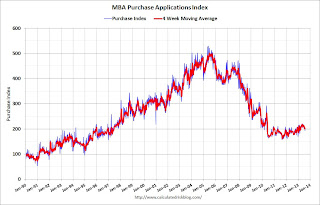

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage rates were little changed last week, but remain roughly one percentage point higher than they were three months ago,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Refinance application volume continues to decline, with the refinance index now more than 55 percent lower than its recent peak, reaching the lowest level in over two years. Applications for home purchases dropped for the fourth time in five weeks, but purchase volume is running about 5 percent higher than last year at this time.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) was unchanged at 4.58 percent, with points decreasing to 0.38 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 11 of the last 12 weeks.

This index is down 57% over the last twelve weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 5% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 5% from a year ago.

No comments:

Post a Comment