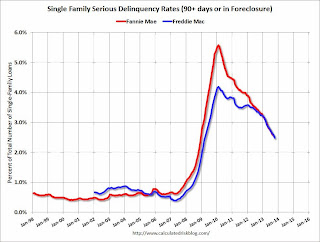

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for October next week.

Click on graph for larger image

Click on graph for larger imageAlthough this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen from 3.31% in October 2013 - and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-to-late 2015.

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications. Therefore I expect an above normal level of distressed sales for 2+ years (mostly in judicial states).

No comments:

Post a Comment